Qualcomm’s attempt to acquire Intel: a game-changing move for the tech industry

October 3, 2024

The Wall Street Journal recently broke a story that sent shockwaves through the tech industry: Qualcomm is in negotiations to acquire Intel for $87 billion. This deal could radically reshape the semiconductor market, positioning Qualcomm as the largest chipmaker in the world and offering Intel a lifeline amid the crisis it has faced in recent years.

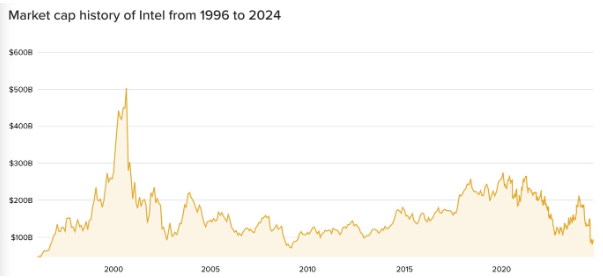

This news comes at a time when Intel, once the undisputed giant in the processor market, has been struggling to stay relevant. The company has faced delays in the production of its new processors and has lost market share to competitors like AMD and NVIDIA. In early August, Intel announced a major business restructuring, laying off 15,000 employees and significantly cutting its investment in research and development.

Regulatory hurdles and lessons from the past

Despite the magnitude of the deal, the success of this merger is far from guaranteed. Mergers between major chip manufacturers often face intense regulatory scrutiny. A recent example is the failed acquisition of ARM by NVIDIA in 2022, which was blocked by the Federal Trade Commission (FTC) and the European Commission after two years of regulatory pressure.

The combination of Qualcomm and Intel could be seen as a threat to competition in the semiconductor industry, likely facing similar challenges. Regulatory authorities might argue that the acquisition would stifle innovation and increase consumer prices.

What this acquisition means for the chip industry

If the deal goes through, Qualcomm would expand its dominance beyond the mobile chip market, gaining a strong foothold in the computer, server, and artificial intelligence sectors. In terms of influence, this would allow Qualcomm to play a key role in shaping emerging technologies like AI.

Despite the potential benefits for Qualcomm, the acquisition also raises concerns about the creation of a monopoly in the semiconductor market. If approved, Qualcomm would become a dominant player with outsized influence over a critical part of the tech industry. This level of control could not only stifle smaller competitors but also affect pricing dynamics, leaving consumers vulnerable to higher costs or fewer options. Additionally, in a volatile market like tech, where new startups can revolutionize the industry, a consolidation of this magnitude could hinder innovation and shut the door on new players.

The potential impact extends beyond the tech industry. Geopolitical implications are also at play, with governments around the world closely watching how this consolidation could affect global supply chains. The recent semiconductor crisis has underscored how concentrated production and development in the hands of a few companies can have massive economic and strategic repercussions.

Intel, on the other hand, faces an uncertain future if the merger doesn’t happen. The company is at a disadvantage against competitors that have adopted more efficient technologies and embraced ARM architecture, leaving Intel with the tough task of reinventing itself to avoid becoming obsolete.

Looking ahead: what to expect from this potential merger

Talks are ongoing, and the outcome of these negotiations will have repercussions that could shape the future of technology for the next decade. Industry analysts agree that, whether or not the acquisition happens, the chip industry is at a turning point. What happens with Qualcomm and Intel will be a clear indicator of where competition and innovation in the global tech market are headed.

However, from a more cautious perspective, it’s also crucial to consider whether massive mergers like this could trigger unforeseen consequences. While the synergies between Qualcomm and Intel could bring immediate benefits to both companies and certain technological advancements, the risk of a less dynamic market is real. The key question is whether, in the end, this consolidation will serve consumer interests or if it will mark the beginning of a less competitive market dominated by a few large corporations. It’s an uncertain terrain, where regulatory decisions, the balance of power, and the ability of smaller competitors to survive will have a long-term impact on the direction of the industry.