Max’s Bet: a game-changer or a risky move in streaming?

November 18, 2024

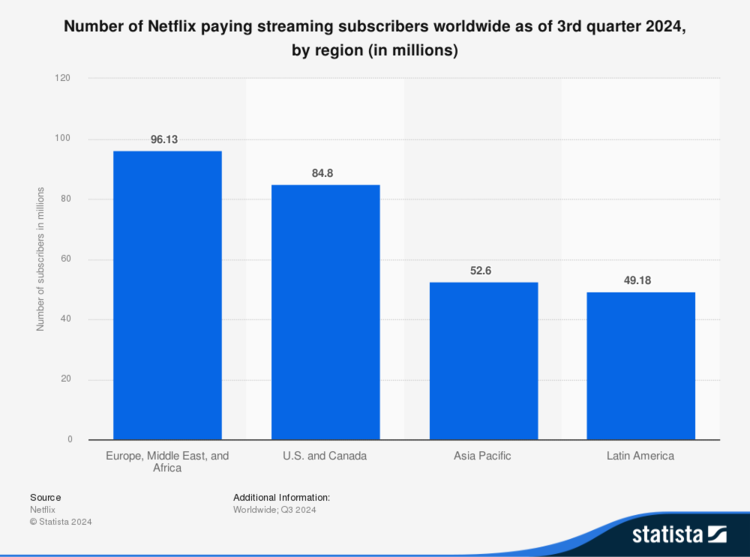

The streaming market is in a phase of consolidation and intense competition. While platforms like Disney+ and Netflix have leaned into localized strategies to capture global audiences, Max, Warner Bros. Discovery Inc.’s streaming service, is taking a different approach: relying on its Hollywood hits to expand into international markets like Asia.

Is this strategy an innovative response to market saturation, or a risky move that could alienate audiences increasingly drawn to local content?

The trend: betting on local content

In recent years, major platforms have realized that to remain relevant in international markets, they must adapt to the cultural preferences of each region. Netflix, for instance, has invested millions in local productions like Money Heist in Spain and Squid Game in South Korea, achieving unexpected global successes. Similarly, Disney+ is exploring collaborations and exclusive content in key markets to differentiate itself.

These strategies have transformed local content industries, creating cultural phenomena and boosting engagement with diverse audiences.

Max: going all-In on Hollywood

Max is challenging this trend with its strategy. Its expansion into Asia won’t involve significant investments in local content. Instead, it will rely on the global appeal of its Hollywood franchises and productions, such as Harry Potter, Game of Thrones, and the extensive Warner Bros. catalog.

The rationale? Warner Bros. Discovery believes its steady stream of high-quality productions can resonate universally, avoiding the high costs of creating regional content, which doesn’t always guarantee a positive return on investment.

However, this stance contrasts with market data. A study by Parrot Analytics shows that global audiences are increasingly drawn to stories reflecting their culture, language, and local context.

The risk of falling behind

While Max’s strategy is logical in terms of cost optimization, it could face significant challenges:

- Direct Competition: Netflix, Disney+, and other players investing in local productions have already built strong footholds in Asia. Max will need more than Hollywood hits to draw attention away from these platforms.

- Cultural Disconnect: In markets where local content is booming, Max could be perceived as less relevant. Consumer loyalty in streaming hinges not just on quality but also on emotional connection.

- Global Precedents: Some of the biggest streaming successes in recent years have been local content that transcended borders. By ignoring this trend, Max could limit its ability to capture viral phenomena.

A strategy to stand out

On the other hand, Max’s approach isn’t entirely out of touch with market needs. In a landscape where competition for local content is fierce, Max could stand out as the exclusive hub for top-tier Hollywood content. Its strategy might attract nostalgic audiences or die-hard fans of its iconic franchises.

The challenge will be whether this is enough to build a loyal subscriber base in a market accustomed to having plenty of options.

Conclusion: balancing innovation and risk

Max is rewriting the rules of streaming with a strategy that prioritizes global appeal over local relevance. While its extensive Hollywood catalog is a competitive advantage, overlooking the growing demand for local content might limit its reach in key markets.

The question now is whether viewers will continue to favor Hollywood blockbusters or gravitate toward stories closer to home. In an ecosystem where personalization and emotional connection are vital, Max walks a fine line between standing out and falling behind.

Will this turn out to be a brilliant strategic move or a misstep that sets a cautionary precedent? Only time—and subscriptions—will tell.